Despite sanctions, Russia's budget revenues for January–August surged by 56% compared to the same period last year. A clandestine tanker fleet enables the country to continue trading, bypassing the imposed price cap. And the Kremlin remains financially equipped to sustain its war efforts. High oil prices, driven by OPEC+ production cuts, further bolster the Kremlin’s position. Experts convincingly make the case that curbing these excess profits is still possible, but doing so would require not only stricter enforcement of the oil price cap, but also a reduction in the cap itself. Other proposed measures include stopping Russia’s shadow fleet and imposing sanctions on Western oil service companies that continue to operate in Russia.

Content

The oil sanctions already in place

Why sanctions did not work as expected

Five steps that could make sanctions effective

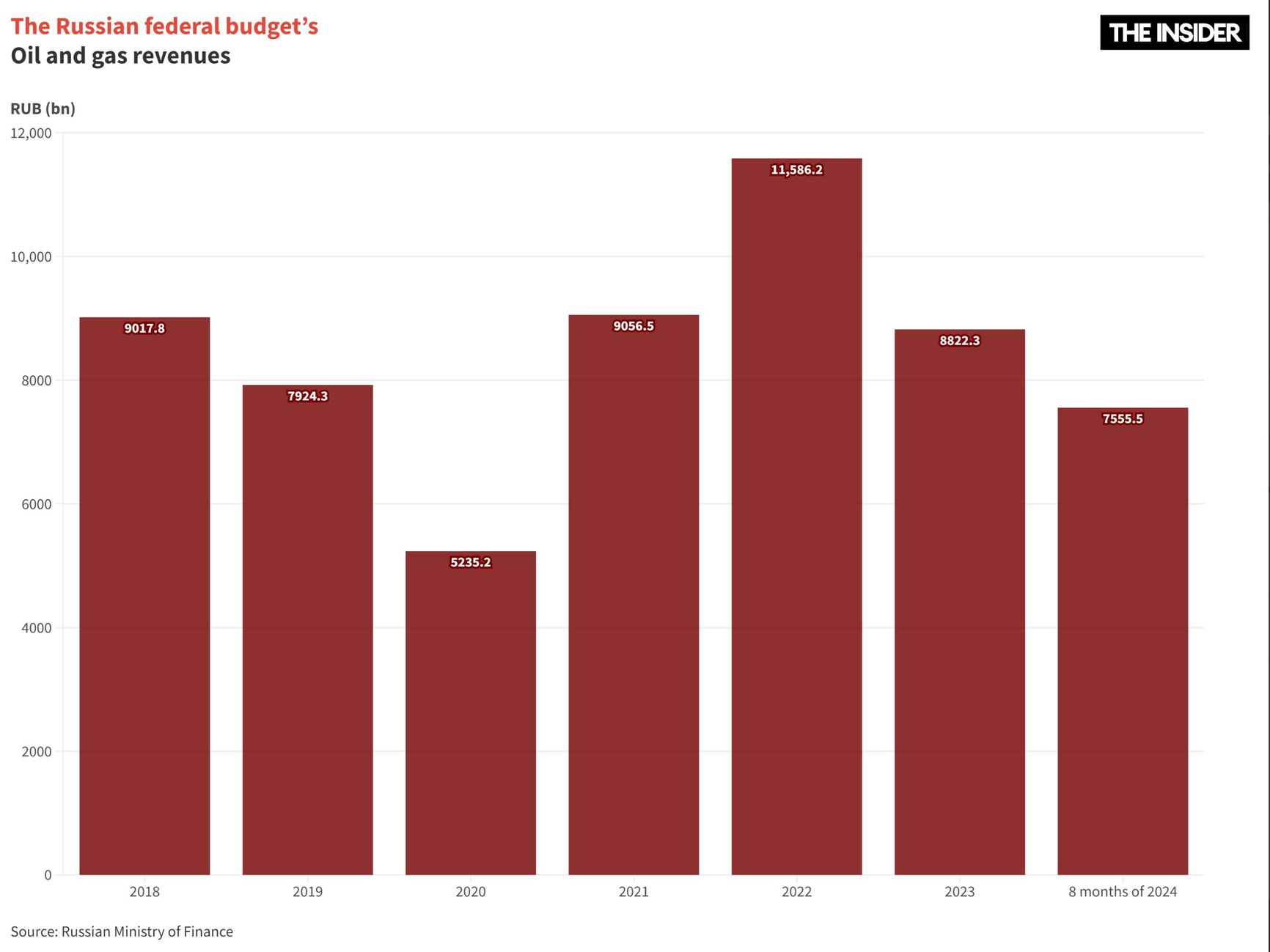

Oil and gas revenues to Russia's federal budget have reached 7.5 trillion rubles ($81 billion) in the first eight months of 2024, according to the Russian Ministry of Finance. This is 50% higher than the same period last year and nearly matches the record 7.8 trillion rubles ($84 billion) collected by this point in 2022, when Russia’s invasion of Ukraine sent global prices soaring. So far, 69% of Russia’s annual target for oil revenues has been achieved. However, even this income falls short of covering the government's growing expenses, which have risen due to the war. Still, the outcome is far from what Western policymakers anticipated when they imposed oil sanctions back in 2022. The question of what more needs to be done in order to prevent Russia from earning the money it needs to fund the war remains a hotly debated topic among economists.

There are vastly different solutions on offer. Some, like Vladimir Milov, advocate radically tightening sanctions, perhaps by closing the Danish Straits to tankers transporting Russian oil in violation of the price cap. Others, like Vladislav Inozemtsev, propose scrapping the price cap entirely, arguing that if all sanctions are lifted and oil is purchased in the same volumes as today, prices will drop again, and Russian revenues will fall right along with it.

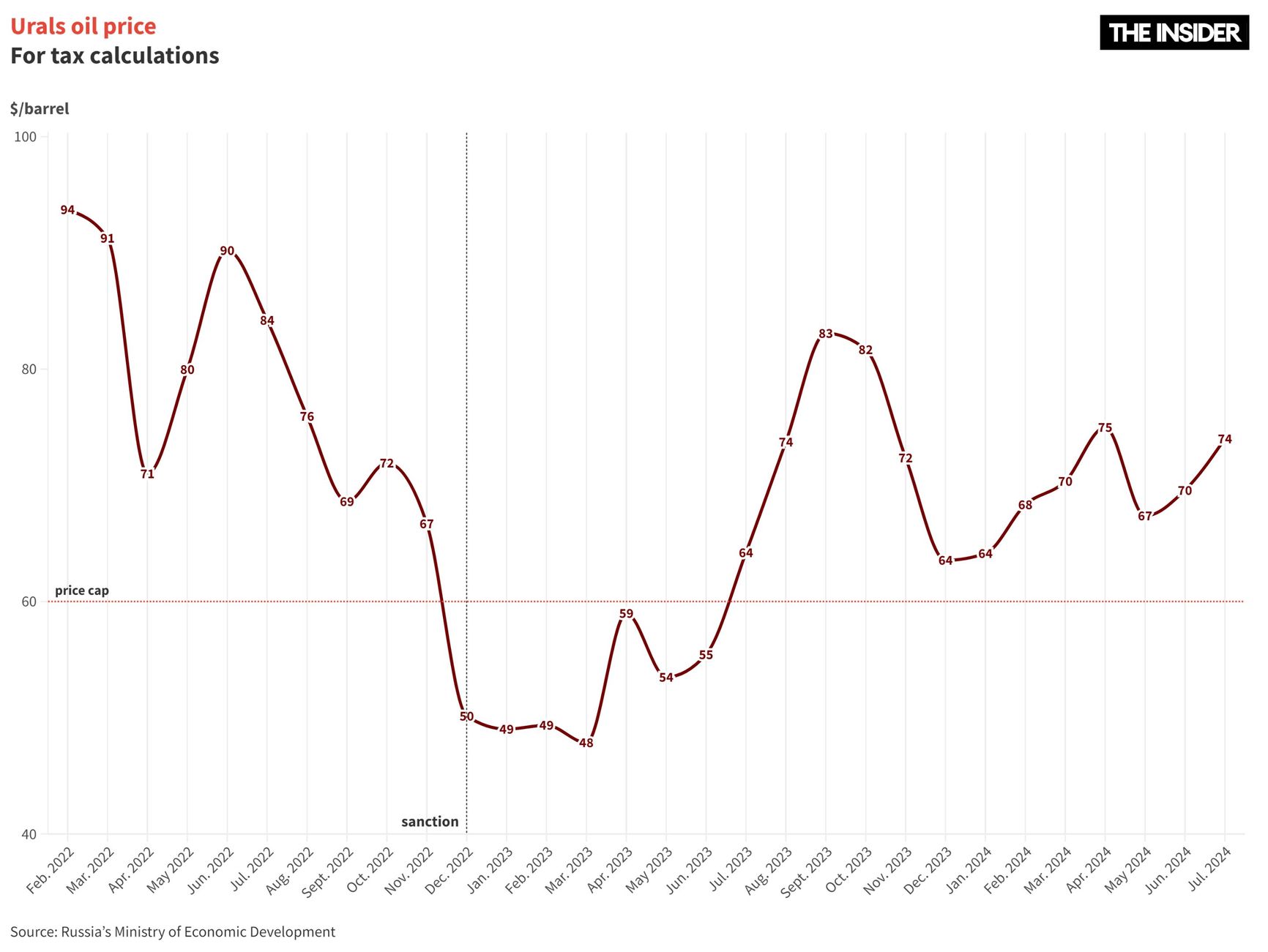

Currently, the Russian budget assumes an oil price of $65 per barrel for Urals crude. If the price falls to $60 per barrel, the treasury no longer reaps windfall profits and ceases to contribute to the National Wealth Fund (NWF). If the price falls further, that fund is depleted ever more rapidly. Right now, the NWF holds 12.2 trillion rubles (about $133 billion, or 6.4% of Russia’s GDP), of which 4.8 trillion ($52 billion) are easily accessible. The liquid part will be exhausted first, after which the government may sell its stakes in certain projects, effectively drawing money from the non-liquid portion of its assets. According to analysts, if current conditions persist, these financial reserves could last for at least two more years. Moreover, the average price of Urals oil is still hovering around $69.8 per barrel, and production is only slightly declining.

The oil sanctions already in place

The main sanctions against Russia's oil sector have included a near total European Union embargo on Russian oil and oil products delivered by sea, along with the oil price cap imposed by the EU in conjunction with Australia, Canada, Japan, the United Kingdom, and the United States. In response, Russia has banned its companies from supplying oil and fuel to countries and firms that enforce this price cap.

This combination of the embargo and the price cap is an innovative mechanism intended to allow Russian oil to remain on the global market — thus preventing shortages and sharp price spikes — while simultaneously cutting Russian budget revenues. These restrictions have been in effect for oil since December 5, 2022, and for gasoline, diesel, fuel oil, and other petroleum products since February 5, 2023.

In September 2022, European Commission President Ursula von der Leyen commented on the hard-won sanctions agreement, saying that, “The oil price cap will help reduce Russia's revenues.” However, in 2024 Russia’s oil and gas revenues are expected to again approach their pre-sanctions 2022 levels.

The deficit has already reached nearly 1 trillion rubles ($11 billion), or 0.5% of GDP, and by the end of the year, it is expected to double.

The so-called «price cap coalition» includes the EU countries and the G7 nations (the UK, Germany, Italy, Canada, France, Japan, and the US), with Australia later joining them.

The oil price cap is a ban on maritime transport companies (such as brokers, shipowners, and insurers) from the G7 countries, the EU, and Australia dealing with Russian oil sold for more than $60 per barrel.

There are also caps for petroleum products: $100 per barrel for diesel, gasoline, and kerosene, and $45 for fuel oil.

These measures were intended to reduce Russia's budget revenues without cutting the global oil supply. The latter aim was particularly important in order to avoid another sharp spike in prices.

After all, Russia accounts for 10% of the global oil and petroleum products market.

The IEA had expected Russian oil production to drop to 9.6 million barrels per day in 2023. In reality, production reached 10.9 million barrels per day. The forecast for 2024 is 10.7 million barrels per day.

The second largest oil refiner in India is 49.13% owned by Rosneft.

The so-called “damper” is a mechanism designed to equalize the profitability of sales for refineries in domestic and foreign markets. When global prices are high, the budget subsidizes oil producers, while in times of low prices, the oil producers contribute to the budget.

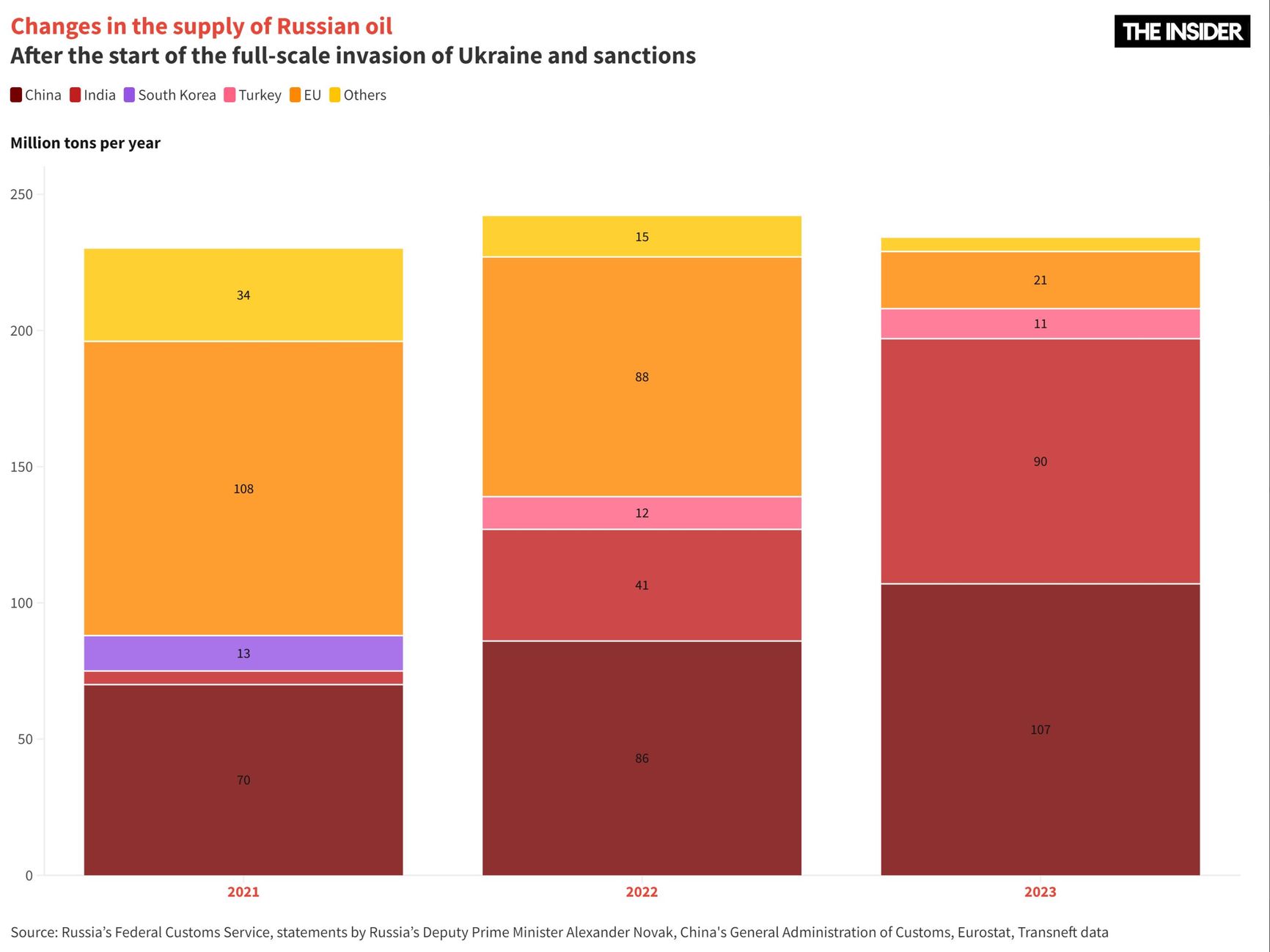

The International Energy Agency (IEA) also miscalculated, predicting a sharp drop in Russian oil production. The agency did not anticipate that China, India, and Turkey would increase their imports of Russian oil so dramatically. According to the IEA's initial estimates, other countries not imposing sanctions would have needed to triple their imports of Russian oil to compensate for Russia’s losses. “We don’t believe this is feasible,” the agency wrote in November 2022. And yet, China and India have bought up nearly all the oil Europe refused to purchase. China increased its imports by 24% , while India really did nearly triple its purchases, boosting them by a factor of 2.6. Turkey played a smaller role but nevertheless accounted for one-tenth of Russia’s export market for petroleum products, increasing its intake by 2.5 times. As a result, Russia has become the largest supplier of raw materials to all three countries. In 2023, Russia exported nearly 234.3 million tons of oil — only 3.3%, less than in the pre-sanctions period of 2022.

The deficit has already reached nearly 1 trillion rubles ($11 billion), or 0.5% of GDP, and by the end of the year, it is expected to double.

The so-called «price cap coalition» includes the EU countries and the G7 nations (the UK, Germany, Italy, Canada, France, Japan, and the US), with Australia later joining them.

The oil price cap is a ban on maritime transport companies (such as brokers, shipowners, and insurers) from the G7 countries, the EU, and Australia dealing with Russian oil sold for more than $60 per barrel.

There are also caps for petroleum products: $100 per barrel for diesel, gasoline, and kerosene, and $45 for fuel oil.

These measures were intended to reduce Russia's budget revenues without cutting the global oil supply. The latter aim was particularly important in order to avoid another sharp spike in prices.

After all, Russia accounts for 10% of the global oil and petroleum products market.

The IEA had expected Russian oil production to drop to 9.6 million barrels per day in 2023. In reality, production reached 10.9 million barrels per day. The forecast for 2024 is 10.7 million barrels per day.

The second largest oil refiner in India is 49.13% owned by Rosneft.

The so-called “damper” is a mechanism designed to equalize the profitability of sales for refineries in domestic and foreign markets. When global prices are high, the budget subsidizes oil producers, while in times of low prices, the oil producers contribute to the budget.

The IEA did not anticipate that China, India, and Turkey would increase their imports of Russian oil so dramatically

And some EU continue to legally purchase Russian oil. Exceptions to the embargo were made for Bulgaria, which imported 5.5 million tons by sea in 2023. Additionally, pipeline oil is entirely exempt from the sanctions, with Hungary, the Czech Republic (where imports of Russian oil are at record levels), Slovakia, Poland, the Netherlands, and Austria representing its chief customers. Still, the overall volume of deliveries to the EU decreased by a factor of four in 2023 (down to 21.3 million tons), and Russia’s revenue from these sales declined by a factor of six (to €9 billion).

The deficit has already reached nearly 1 trillion rubles ($11 billion), or 0.5% of GDP, and by the end of the year, it is expected to double.

The so-called «price cap coalition» includes the EU countries and the G7 nations (the UK, Germany, Italy, Canada, France, Japan, and the US), with Australia later joining them.

The oil price cap is a ban on maritime transport companies (such as brokers, shipowners, and insurers) from the G7 countries, the EU, and Australia dealing with Russian oil sold for more than $60 per barrel.

There are also caps for petroleum products: $100 per barrel for diesel, gasoline, and kerosene, and $45 for fuel oil.

These measures were intended to reduce Russia's budget revenues without cutting the global oil supply. The latter aim was particularly important in order to avoid another sharp spike in prices.

After all, Russia accounts for 10% of the global oil and petroleum products market.

The IEA had expected Russian oil production to drop to 9.6 million barrels per day in 2023. In reality, production reached 10.9 million barrels per day. The forecast for 2024 is 10.7 million barrels per day.

The second largest oil refiner in India is 49.13% owned by Rosneft.

The so-called “damper” is a mechanism designed to equalize the profitability of sales for refineries in domestic and foreign markets. When global prices are high, the budget subsidizes oil producers, while in times of low prices, the oil producers contribute to the budget.

Before the war, about 60% of Russia’s 230 million tons of exported oil went westward, while 40% went east. Now, according to the country’s Deputy Prime Minister Alexander Novak, only 15% is moving west, while 85% is directed east. He stated that the situation has “essentially stabilized.”

This pivot to the East has not come without costs for Russian companies. To maintain supply volumes, they had to lower prices, selling oil at a discount. As a result, companies lost $5.3 billion in potential revenue from deliveries to China in 2022 and $3.7 billion between January and September 2023, according to the Gaidar Institute. Since then, the discount has been gradually decreasing, at least according to Novak’s claims.

Further worsening the condition of the Russian oil industry — and thus reducing production and refining volumes — are restrictions on equipment supplies imposed by the U.S. and EU. The issue has become particularly acute following an increase in Ukrainian drone attacks on oil refineries, almost all of which rely on foreign equipment that is subject to sanctions. However, producers hope to replace Western equipment with Asian alternatives. Until Rosstat classified data on petroleum product production, statistics showed only a slight decline in refining after the attacks, indirectly confirming companies' statements that the damages were minor and that the plants were quickly returning to operation.

Why sanctions did not work as expected

Shadow fleet

Russia's income is being bolstered by its shadow fleet, which consists of Russian vessels purchased by Sovcomflot or tankers from jurisdictions that have not signed on to the price cap. These ships do not use insurance or financing from Western countries and thus do not technically violate any laws while transporting Russian oil being sold at prices above $60 per barrel. They rely on services from Russian companies as well as from a range of newly established shipping, trading, and insurance firms based in India, the UAE, and Hong Kong.

Approximately 74% of Russia's oil exports are transported by sea, and these exports are subject to Western restrictions. Last year, shadow vessels accounted for up to 45% of oil and petroleum products exported from the country by sea, comprising around 1,000 tankers. Thus, in 2023, they facilitated more than a third of Russia’s oil exports.

Given the tighter constraints imposed by the EU at the end of 2023 under the 12th sanctions package, as well as America’s increasingly active enforcement of secondary sanctions against companies working with these tankers, the share of shadow transportation may decrease in 2024. However, the decrease is expected to be modest, as new ships are taking the place of those subjected to sanctions. The global shadow fleet has existed for decades and was previously utilized by Iran, Iraq, and Venezuela. Russia is simply the latest in a long line of rogue energy power to turn to such service providers.

Leaky ceiling

Formally, the “gray” fleet accounts for less than half of Russia’s maritime transport of oil — meaning that more than half of the shipments were made quite officially, through what is often referred to as “white” transport. “White” tankers operate within the constraints imposed by Western sanctions. However, the average price of Russian oil suggests that the level of “gray” shipments is actually higher than is commonly understood.

This reality indicates that the countries imposing restrictions on the shipment of Russian oil are unable to ensure that their own companies comply with the sanctions. This is partly due to the oil market's opacity and complexity. The actual price stated in a contract is known only to the seller and buyer and may not match the price declared in customs documents or paperwork in the possession of the carrier. This is particularly true when, for instance, Rosneft sells oil to its own subsidiary, Nayara Energy. Carriers and insurers complain that they have almost no reliable means of verifying the actual price of the oil they are transporting, nor do they receive clear instructions on what to do if they suspect that the sender is engaging in dishonest practices. British directives for companies dealing with Russian oil state that carriers should request price verification documents from the seller, and that if official documents are unavailable, they should obtain something akin to a receipt confirming that no sanctions are being violated.

Another issue is that the penalties for violating price restrictions are relatively mild. A vessel caught transporting oil priced over $60 per barrel will be banned from transporting oil for 90 days, and insurance, brokerage, and other types of companies involved in the transaction may face fines.

The deficit has already reached nearly 1 trillion rubles ($11 billion), or 0.5% of GDP, and by the end of the year, it is expected to double.

The so-called «price cap coalition» includes the EU countries and the G7 nations (the UK, Germany, Italy, Canada, France, Japan, and the US), with Australia later joining them.

The oil price cap is a ban on maritime transport companies (such as brokers, shipowners, and insurers) from the G7 countries, the EU, and Australia dealing with Russian oil sold for more than $60 per barrel.

There are also caps for petroleum products: $100 per barrel for diesel, gasoline, and kerosene, and $45 for fuel oil.

These measures were intended to reduce Russia's budget revenues without cutting the global oil supply. The latter aim was particularly important in order to avoid another sharp spike in prices.

After all, Russia accounts for 10% of the global oil and petroleum products market.

The IEA had expected Russian oil production to drop to 9.6 million barrels per day in 2023. In reality, production reached 10.9 million barrels per day. The forecast for 2024 is 10.7 million barrels per day.

The second largest oil refiner in India is 49.13% owned by Rosneft.

The so-called “damper” is a mechanism designed to equalize the profitability of sales for refineries in domestic and foreign markets. When global prices are high, the budget subsidizes oil producers, while in times of low prices, the oil producers contribute to the budget.

A vessel caught transporting oil priced over $60 per barrel will simply be banned from transporting oil for 90 days

There are also exceptions to the restrictions. Russian oil priced above $60 per barrel can be legally transported by sea if it pertains to an emergency, the prevention of an emergency, or the mitigation of an emergency’s consequences. Additionally, non-Russian oil priced above the cap can be exported from Russian ports provided that it does not belong to a person connected to Russia.

This quantity of loopholes offers a variety of options for those looking to violate the spirit of the sanctions.

Budget maneuvers

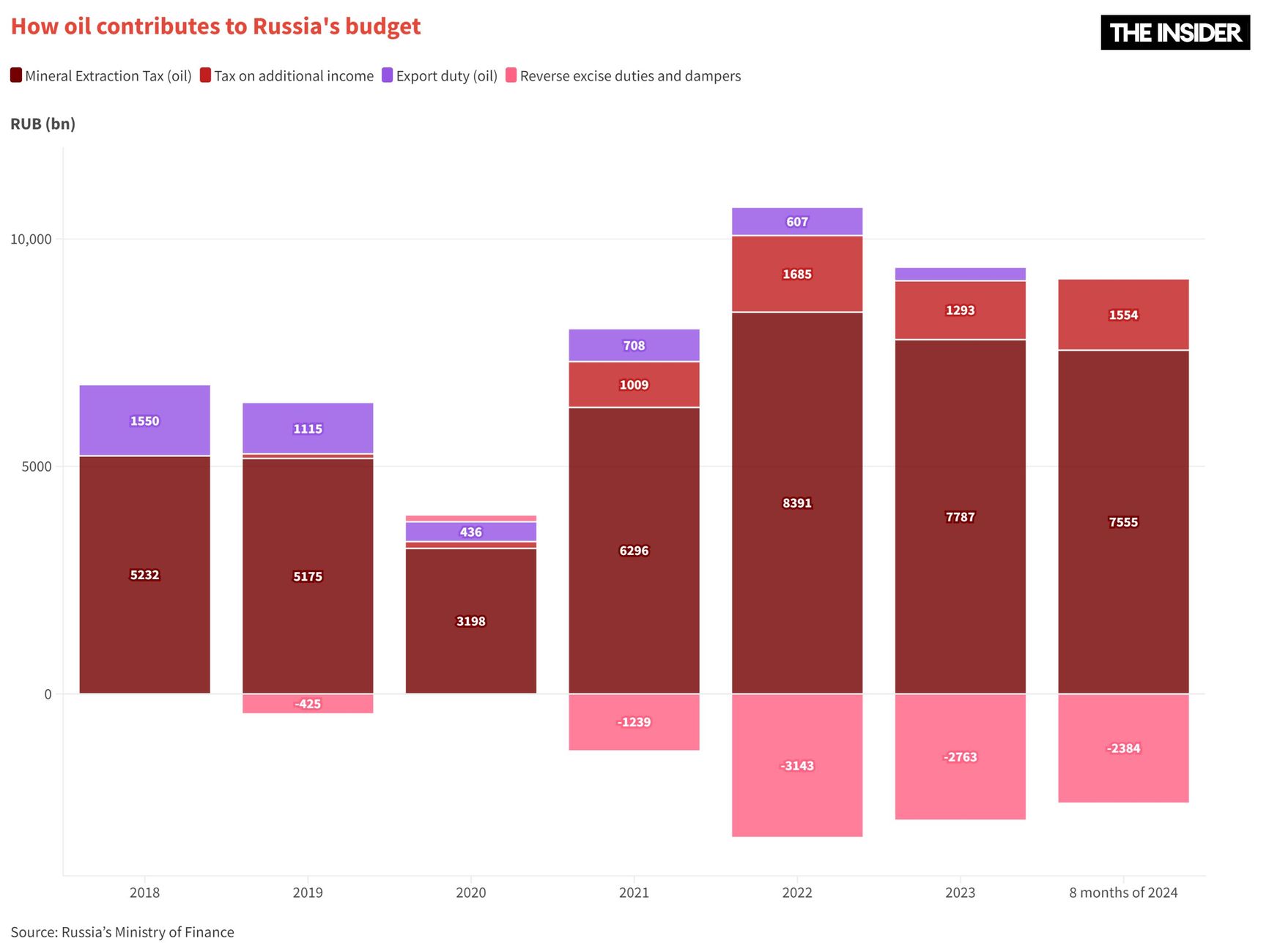

Russia has long made efforts to lessen the state budget’s dependence on the volume of exported oil and petroleum products, and this is another reason why it continues to replenish its coffers. As early as 2014, the so-called “tax maneuver” began, in which export duties were reduced while the mineral extraction tax (MET) was increased. This maneuver concluded in 2024: as of January 1, duties on oil and petroleum products were eliminated, and revenue now comes solely “from the well” — as soon as companies extract oil, they owe money to the budget.

The decline in export revenues, which Western officials celebrate, primarily presents a problem for Russian energy companies, not for the state itself. The impact of sanctions on the budget is of course real, but its effects are indirect and delayed. Factors directly affecting the budget are: the volume of oil production, the price used to calculate the MET, the tax on additional income (AIT), and the exchange rate of the ruble (since prices are accounted for in dollars).

The deficit has already reached nearly 1 trillion rubles ($11 billion), or 0.5% of GDP, and by the end of the year, it is expected to double.

The so-called «price cap coalition» includes the EU countries and the G7 nations (the UK, Germany, Italy, Canada, France, Japan, and the US), with Australia later joining them.

The oil price cap is a ban on maritime transport companies (such as brokers, shipowners, and insurers) from the G7 countries, the EU, and Australia dealing with Russian oil sold for more than $60 per barrel.

There are also caps for petroleum products: $100 per barrel for diesel, gasoline, and kerosene, and $45 for fuel oil.

These measures were intended to reduce Russia's budget revenues without cutting the global oil supply. The latter aim was particularly important in order to avoid another sharp spike in prices.

After all, Russia accounts for 10% of the global oil and petroleum products market.

The IEA had expected Russian oil production to drop to 9.6 million barrels per day in 2023. In reality, production reached 10.9 million barrels per day. The forecast for 2024 is 10.7 million barrels per day.

The second largest oil refiner in India is 49.13% owned by Rosneft.

The so-called “damper” is a mechanism designed to equalize the profitability of sales for refineries in domestic and foreign markets. When global prices are high, the budget subsidizes oil producers, while in times of low prices, the oil producers contribute to the budget.

Russia itself has committed to reducing the first of these variables — the volume of oil it extracts — by supporting OPEC+ agreements on production cuts. The rationale in Moscow is that by reducing production and exports, Russia will benefit from higher prices. Although the government has classified the relevant statistical data, the Bank of Russia reports that production is indeed decreasing. However, this reduction is still less than what Russia promised its OPEC partners. Therefore, when other OPEC+ countries begin gradually increasing exports, Russia will be forced to compensate for the “under-reduced” volumes.

Approximately half of all oil produced in Russia is processed domestically (and about half of the resulting fuel is then exported). In this way, the domestic market also supports the budget.

And of course, there are various other factors at play. To protect its budget from the predictable effects of a potential decline in global energy prices, Russia has tied its taxes to global indicators. The payments from oil extraction companies depend on the price announced monthly by the Ministry of Economic Development. This price may not match the average price at which a specific company sold its oil, and moreover, it may not even align with the average price of Russian Urals oil if that price is deemed to be too low. This represents a sort of “floor price for oil,” a Russian response to the Western price cap. The “floor” is also intended to rise higher each year.

The deficit has already reached nearly 1 trillion rubles ($11 billion), or 0.5% of GDP, and by the end of the year, it is expected to double.

The so-called «price cap coalition» includes the EU countries and the G7 nations (the UK, Germany, Italy, Canada, France, Japan, and the US), with Australia later joining them.

The oil price cap is a ban on maritime transport companies (such as brokers, shipowners, and insurers) from the G7 countries, the EU, and Australia dealing with Russian oil sold for more than $60 per barrel.

There are also caps for petroleum products: $100 per barrel for diesel, gasoline, and kerosene, and $45 for fuel oil.

These measures were intended to reduce Russia's budget revenues without cutting the global oil supply. The latter aim was particularly important in order to avoid another sharp spike in prices.

After all, Russia accounts for 10% of the global oil and petroleum products market.

The IEA had expected Russian oil production to drop to 9.6 million barrels per day in 2023. In reality, production reached 10.9 million barrels per day. The forecast for 2024 is 10.7 million barrels per day.

The second largest oil refiner in India is 49.13% owned by Rosneft.

The so-called “damper” is a mechanism designed to equalize the profitability of sales for refineries in domestic and foreign markets. When global prices are high, the budget subsidizes oil producers, while in times of low prices, the oil producers contribute to the budget.

In response to the Western price cap, Russia safeguarded its budget by implementing a “floor price for oil”

This maneuver is expected to provide the state with an additional 815 billion rubles ($9 billion) in budget revenues this year, 1.8 trillion rubles ($19 billion) in 2025, and 2.643 trillion rubles ($28 billion) in 2026.

The deficit has already reached nearly 1 trillion rubles ($11 billion), or 0.5% of GDP, and by the end of the year, it is expected to double.

The so-called «price cap coalition» includes the EU countries and the G7 nations (the UK, Germany, Italy, Canada, France, Japan, and the US), with Australia later joining them.

The oil price cap is a ban on maritime transport companies (such as brokers, shipowners, and insurers) from the G7 countries, the EU, and Australia dealing with Russian oil sold for more than $60 per barrel.

There are also caps for petroleum products: $100 per barrel for diesel, gasoline, and kerosene, and $45 for fuel oil.

These measures were intended to reduce Russia's budget revenues without cutting the global oil supply. The latter aim was particularly important in order to avoid another sharp spike in prices.

After all, Russia accounts for 10% of the global oil and petroleum products market.

The IEA had expected Russian oil production to drop to 9.6 million barrels per day in 2023. In reality, production reached 10.9 million barrels per day. The forecast for 2024 is 10.7 million barrels per day.

The second largest oil refiner in India is 49.13% owned by Rosneft.

The so-called “damper” is a mechanism designed to equalize the profitability of sales for refineries in domestic and foreign markets. When global prices are high, the budget subsidizes oil producers, while in times of low prices, the oil producers contribute to the budget.

The “oil floor” first took effect in January 2024, with authorities setting the tax price for oil at $65 per barrel — based on an average monthly Brent price of $80 per barrel minus a discount of $15, even though the market discount was $18, according to Bloomberg calculations. Recently, however, Urals crude has been priced almost the same as North Sea oil, meaning the government rarely relies on this safeguard.

With this setup, nothing prevents Russian exporters from selling oil below the price cap (whether in reality or just on paper by transferring the product to affiliated intermediaries who then resell it at market value). At the same time, the Ministry of Finance collects taxes from them based on a higher price tied to Brent.

Companies are certainly attempting to contest what they see as an “unjustified increase in the tax burden.” However, their operations currently appear to be stable. In fact, all major players reported profits last year, as well as in the first half of 2024. Rosneft announced a net profit of 773 billion rubles ($8 billion) over six months, marking a 27% increase from the same period in 2023. Surgutneftegas reported a profit of 140 billion rubles ($1.5 billion), a drop of 83%. Gazprom Neft showed 328 billion rubles ($3.5 billion) in profit, an 8% increase, and is already planning to distribute dividends. And Lukoil posted a profit of 591.5 billion rubles ($6.3 billion), up 5%.

When it comes to oil products, the price cap and embargo have an even less direct impact on budget revenues. The budget is not directly influenced by the volume of fuel exported to foreign markets, allowing the government to easily impose bans on the export of gasoline and diesel fuel. The Russian budget benefits more from exporting crude oil than from processed products, as this approach eliminates the need to compensate refiners for rising global prices — often referred to as the “fuel damper”. Only if external prices drop to a level at which producing fuel becomes unprofitable could this affect extraction. However, Russia has a substantial domestic market, one in which shortages of certain fuel types are not uncommon, meaning demand for Russian energy products should not be an issue.

“The Russian economy is demonstrating high growth rates. Consumption of motor fuels and other oil products, lubricants, bituminous materials, and petrochemical products is increasing. Both the industry as a whole and Gazprom Neft are responding to this by increasing production and supply volumes to the domestic market,” Gazprom Neft chairman Alexander Dyukov reported to Vladimir Putin on Jul. 2.

The deficit has already reached nearly 1 trillion rubles ($11 billion), or 0.5% of GDP, and by the end of the year, it is expected to double.

The so-called «price cap coalition» includes the EU countries and the G7 nations (the UK, Germany, Italy, Canada, France, Japan, and the US), with Australia later joining them.

The oil price cap is a ban on maritime transport companies (such as brokers, shipowners, and insurers) from the G7 countries, the EU, and Australia dealing with Russian oil sold for more than $60 per barrel.

There are also caps for petroleum products: $100 per barrel for diesel, gasoline, and kerosene, and $45 for fuel oil.

These measures were intended to reduce Russia's budget revenues without cutting the global oil supply. The latter aim was particularly important in order to avoid another sharp spike in prices.

After all, Russia accounts for 10% of the global oil and petroleum products market.

The IEA had expected Russian oil production to drop to 9.6 million barrels per day in 2023. In reality, production reached 10.9 million barrels per day. The forecast for 2024 is 10.7 million barrels per day.

The second largest oil refiner in India is 49.13% owned by Rosneft.

The so-called “damper” is a mechanism designed to equalize the profitability of sales for refineries in domestic and foreign markets. When global prices are high, the budget subsidizes oil producers, while in times of low prices, the oil producers contribute to the budget.

The exchange rate of the ruble also plays an important role. The ruble appreciated over the summer due to decreased demand for dollars and euros following the imposition of sanctions on the Moscow Exchange and the cessation of trading in U.S. dollars and EU currencies. This raised concerns within the financial sector. Additionally, demand for dollars and euros is reduced by restrictions on the import of goods from Western countries. Such strengthening could actually cost the budget 750 billion rubles ($8 billion) out of the 10.7 trillion rubles ($115 billion) in expected oil and gas revenues for 2024, and it has the potential to become a serious issue in 2025, when the budget assumes an exchange rate of 100 rubles per dollar.

Five steps that could make sanctions effective

The Insider consulted several experts on potential measures to enhance the effectiveness of sanctions. Their key recommendations can be distilled into five main points.

1. Strengthen control over the price cap. Imposing sanctions on individuals and companies that assist Russian exporters in trading below the price cap — whether these actors operate through the shadow fleet or contract price manipulations — is the most obvious and straightforward measure. This could be sufficient to deter intermediaries from helping Russian exporters find loopholes for circumventing sanctions.

2. Lower the price cap. At $60 per barrel, the price is quite comfortable for Russia. The Western coalition struggled to reach an agreement and settled on a compromise that only created the illusion of active anti-Russian sanctions (primarily for voters). Even if the restrictions were effectively enforced, at $60 per barrel the results would still be insufficient.

However, Russian revenues from the export of oil would significantly decrease at a price of $40 per barrel, even if the shadow fleet were to continue its operations. Even if such a cap were only partially effective, it could cost Russia up to $35 billion per year, according to an international group of economists. When the Western compromise around the $60 price cap was agreed upon, it was intended that the level would be regularly reviewed, but this has not yet happened.

3. Monitor the shadow fleet through the Danish straits. Closing the straits to specific vessels is not a straightforward process, as it would violate the United Nations Convention on the Law of the Sea (UNCLOS), which guarantees all ships the right of innocent passage through territorial waters and, more importantly, through the economic zones of individual countries. The issue is further complicated by the absence of an internationally recognized registry for shadow vessels, says Elizabeth Braw, a senior fellow at the Atlantic Council's Transatlantic Security Initiative.

The deficit has already reached nearly 1 trillion rubles ($11 billion), or 0.5% of GDP, and by the end of the year, it is expected to double.

The so-called «price cap coalition» includes the EU countries and the G7 nations (the UK, Germany, Italy, Canada, France, Japan, and the US), with Australia later joining them.

The oil price cap is a ban on maritime transport companies (such as brokers, shipowners, and insurers) from the G7 countries, the EU, and Australia dealing with Russian oil sold for more than $60 per barrel.

There are also caps for petroleum products: $100 per barrel for diesel, gasoline, and kerosene, and $45 for fuel oil.

These measures were intended to reduce Russia's budget revenues without cutting the global oil supply. The latter aim was particularly important in order to avoid another sharp spike in prices.

After all, Russia accounts for 10% of the global oil and petroleum products market.

The IEA had expected Russian oil production to drop to 9.6 million barrels per day in 2023. In reality, production reached 10.9 million barrels per day. The forecast for 2024 is 10.7 million barrels per day.

The second largest oil refiner in India is 49.13% owned by Rosneft.

The so-called “damper” is a mechanism designed to equalize the profitability of sales for refineries in domestic and foreign markets. When global prices are high, the budget subsidizes oil producers, while in times of low prices, the oil producers contribute to the budget.

The Sovcomflot tanker Primorye was sanctioned by the U.S. in October 2023 and remained idle, without loading oil, for approximately six months. However, Bloomberg suspects that in June, the tanker secretly transferred its load of Urals oil to another vessel in the Singapore area

It is more likely that closing the straits will be achieved on environmental grounds, as Denmark plans to do in the Baltic Sea. The International Convention Relating to Intervention on the High Seas in Cases of Oil Pollution Casualties allows countries to “to prevent, mitigate or eliminate grave and imminent danger to their coastline or related interests from pollution or threat of pollution of the sea by oil following upon a maritime casualty or acts related to such a casualty.”

In other words, a country can prohibit a vessel from entering its waters if it presents the apparent threat of an oil spill. Analysts at S&P have calculated that around 397 vessels in the shadow fleet are over 16 years old, with the highest concentration in the 16-20 year age group.

The deficit has already reached nearly 1 trillion rubles ($11 billion), or 0.5% of GDP, and by the end of the year, it is expected to double.

The so-called «price cap coalition» includes the EU countries and the G7 nations (the UK, Germany, Italy, Canada, France, Japan, and the US), with Australia later joining them.

The oil price cap is a ban on maritime transport companies (such as brokers, shipowners, and insurers) from the G7 countries, the EU, and Australia dealing with Russian oil sold for more than $60 per barrel.

There are also caps for petroleum products: $100 per barrel for diesel, gasoline, and kerosene, and $45 for fuel oil.

These measures were intended to reduce Russia's budget revenues without cutting the global oil supply. The latter aim was particularly important in order to avoid another sharp spike in prices.

After all, Russia accounts for 10% of the global oil and petroleum products market.

The IEA had expected Russian oil production to drop to 9.6 million barrels per day in 2023. In reality, production reached 10.9 million barrels per day. The forecast for 2024 is 10.7 million barrels per day.

The second largest oil refiner in India is 49.13% owned by Rosneft.

The so-called “damper” is a mechanism designed to equalize the profitability of sales for refineries in domestic and foreign markets. When global prices are high, the budget subsidizes oil producers, while in times of low prices, the oil producers contribute to the budget.

A country can prohibit a vessel from entering its waters if it presents the apparent threat of an oil spill

4. The U.S. could drive down global oil prices. Given that Russia's budget now hinges on Brent prices rather than Urals, reducing inflows to the Russian budget by driving down the price of oil presents a serious challenge, as such a move would go against the interests of the global oil lobby. Significant price reductions would require decreasing demand, which developed nations are already working towards by reducing their reliance on fossil fuels. Long-term, a shift to renewable energy sources and the widespread adoption of electric vehicles will lead to lower prices, but this is not a short-term prospect. That means reducing prices in the here and now would require increasing the supply of oil. The U.S. could encourage its companies to ramp up production, as has been explained Oleg Itskhoki, a professor at the University of California, Los Angeles. As the world’s largest oil producer, the U.S. could react to any production cuts by OPEC+ countries by reviving shale oil production.

The cost of oil extraction in Russia is around $48 per barrel, according to Rosstat data for Q1 2024. However, a significant portion of this sum consists of taxes and other payments. Exploration, extraction, and transportation costs amount to $25 per barrel, with the remainder being taxes, according to an estimate by Russia’s Deputy Energy Minister Pavel Sorokin in 2019. Initially, lower oil prices would squeeze Russian oil companies’ profitability, though it can be assumed that state-owned companies would continue to meet the Finance Ministry's demands for as long as possible.

“Where patience ends, endurance begins,” remarked Igor Sechin, head of Rosneft, reflecting the industry's mindset. However, eventually, companies will begin to cut costs, starting with non-core activities (such as sponsorships, football club support, and sustainable development), meaning the country would lose its “second budget,” which supports such initiatives. And if these cuts continue for a prolonged period, the primary budget could also be at risk.

5. Deprive Russia of oil workers. The EU and the U.S. have banned the supply to Russia of equipment used for oil extraction. Some of this equipment may be replaced with alternatives, while some could be brought in without the consent of the rights holders. But for companies to operate effectively, they need not only machinery but also skilled personnel, and the West could deprive Russia of its qualified oil workers.

Firstly, this could be achieved by encouraging companies to withdraw from the Russian market. The European Central Bank is actively pressuring Raiffeisenbank's Russian subsidiary to do so. However, attention is often diverted from SLB (formerly Schlumberger), the world’s largest oil services company, which is still operating in Russia. This American company not only remains in the country but has expanded its presence by taking advantage of the exit of major competitors. It continues to procure equipment through Asia, and it employs 10,000 people. The U.S. State Department asserts that the company is not violating sanctions and “fully understands its red lines.”

The deficit has already reached nearly 1 trillion rubles ($11 billion), or 0.5% of GDP, and by the end of the year, it is expected to double.

The so-called «price cap coalition» includes the EU countries and the G7 nations (the UK, Germany, Italy, Canada, France, Japan, and the US), with Australia later joining them.

The oil price cap is a ban on maritime transport companies (such as brokers, shipowners, and insurers) from the G7 countries, the EU, and Australia dealing with Russian oil sold for more than $60 per barrel.

There are also caps for petroleum products: $100 per barrel for diesel, gasoline, and kerosene, and $45 for fuel oil.

These measures were intended to reduce Russia's budget revenues without cutting the global oil supply. The latter aim was particularly important in order to avoid another sharp spike in prices.

After all, Russia accounts for 10% of the global oil and petroleum products market.

The IEA had expected Russian oil production to drop to 9.6 million barrels per day in 2023. In reality, production reached 10.9 million barrels per day. The forecast for 2024 is 10.7 million barrels per day.

The second largest oil refiner in India is 49.13% owned by Rosneft.

The so-called “damper” is a mechanism designed to equalize the profitability of sales for refineries in domestic and foreign markets. When global prices are high, the budget subsidizes oil producers, while in times of low prices, the oil producers contribute to the budget.

The world's largest oil services company, SLB (formerly Schlumberger), continues to operate in Russia, and everyone seems to turn a blind eye

Secondly, the West can achieve this aim by poaching skilled professionals. The U.S. and EU governments could grant most-favored-nation status concerning residency and employment to Russians who have held managerial positions in relevant companies. Alternatively, they could encourage their own companies to specifically recruit these individuals. Replacing such talent would present a significant challenge to Russia, as compensating for the loss with other specialists is both difficult and costly, especially in the context of a general labor shortage. At the very least, compelling Russian companies to train new hires internally would require a considerable investment of time.

The deficit has already reached nearly 1 trillion rubles ($11 billion), or 0.5% of GDP, and by the end of the year, it is expected to double.

The so-called «price cap coalition» includes the EU countries and the G7 nations (the UK, Germany, Italy, Canada, France, Japan, and the US), with Australia later joining them.

The oil price cap is a ban on maritime transport companies (such as brokers, shipowners, and insurers) from the G7 countries, the EU, and Australia dealing with Russian oil sold for more than $60 per barrel.

There are also caps for petroleum products: $100 per barrel for diesel, gasoline, and kerosene, and $45 for fuel oil.

These measures were intended to reduce Russia's budget revenues without cutting the global oil supply. The latter aim was particularly important in order to avoid another sharp spike in prices.

After all, Russia accounts for 10% of the global oil and petroleum products market.

The IEA had expected Russian oil production to drop to 9.6 million barrels per day in 2023. In reality, production reached 10.9 million barrels per day. The forecast for 2024 is 10.7 million barrels per day.

The second largest oil refiner in India is 49.13% owned by Rosneft.

The so-called “damper” is a mechanism designed to equalize the profitability of sales for refineries in domestic and foreign markets. When global prices are high, the budget subsidizes oil producers, while in times of low prices, the oil producers contribute to the budget.